A word about your taxes…

We may be a day late (yesterday was tax day), but we are probably not a dollar short… in fact, under Obama we have a few bucks more than under Bush. Please read below.

-Shepard

http://www.huffingtonpost.com/2010/04/15/tax-day-2010-protesters-i_n_538556.html

Tax Day Fact Check: Most Americans Got A Tax Cut This Year

Sam Stein

Posted: April 15, 2010 07:59 AM

On Tuesday, a wave of protesters, upset with overly-burdensome taxation by the federal government, are set to descend on the nation’s capital to express their displeasure.

But does their anger reflect the truth about today’s tax rates?

After all, neutral economists insist that, under the Obama administration, the overwhelming likelihood is that your tax burden has gone down, not up. Even conservative economic analysts acknowledge that there really is no basis for middle- and working-class Americans to believe that they’re suddenly paying more.

“The only tax I think that has been put in place so far is an increase in the federal cigarette tax. I can’t think of another Obama tax that has gone in place so far,” said Chris Edwards, Director of Tax Policy Studies at the conservative Cato Institute. “I would say that people are angry because big taxes are coming down the road because of the gigantic deficit built up under Bush and continued under Obama.”

And yet, Tuesday is expected to bring a range of hotly-charged rhetoric over the damage this ‘tax-and-spend’ president has done to the general public’s bottom line.

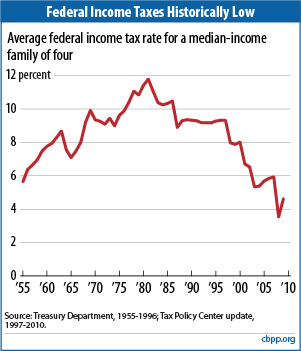

A look at the numbers tells a different story. For starters: the non-partisan Center for Budget and Policy Priorities reported on Wednesday that “Middle-income Americans are now paying federal taxes at or near historically low levels.” How low? The average family of four right now is paying 4.6 percent of its income in federal income taxes — the second lowest percentage in 50 years.

A report from the White House Council of Economic Advisers, meanwhile, asserts that the president’s economic stimulus package has sent more than $200 billion in tax relief and other benefits to mainly middle- and lower-income families since its passage.

Citizens for Tax Justice, a self-described non-partisan organization, released a report on Tuesday that read: “The 2009 economic stimulus bill actually reduced federal income taxes for tax year 2009 for 98 percent of all working families and individuals.” This total includes the 95 percent of working families that will or have received tax credits in the range of $400 to $800.

The health care bill passed by the administration, meanwhile, includes a tax credit that could cover up to 35 percent of the premiums a small business pays to insure its workers. The Recovery Act, meanwhile, included such tax breaks as a $1,500 credit for home energy improvements, and an $8,000 credit for first-time home buyers.

It has been a buffet of tax breaks and credits offered by this administration (occasionally to the chagrin of progressive economists, who want more focus on stimulative federal spending).

Yet polling numbers indicate that Americans are barely aware of these developments. Indeed, a good chunk of the country believes it has been saddled by this administration with tax hikes. Back in mid-February, a full 24 percent of respondents to a CBS News/New York Times poll said that their taxes had increased under Obama. Fifty-three percent said they had stayed the same. Only 12 percent thought their taxes had gone down.

“Belief is triumphing over reality,” explained Bob McIntyre, director of Citizens for Tax Justice. “Part of it is they watch the wrong television shows and believe it. Part of it is the tax cut that went to almost everybody, the making work pay credit, was dribbled out… people didn’t get a check. They paid lower taxes and might not have noticed it.

“It is like arguing whether Jesus rose from the dead,” McIntyre concluded. “If you believe it, you believe it.”

On Thursday, those who don’t believe it will be making their voices heard. At least four separate demonstrations are being planned around the capital in honor of tax day, including two protests next to Congress, an online broadcast “tax revolt” and another rally at the Washington Monument. They will, however, be countered by a start-up group called “The Other 95%,” which will descend on D.C. on Thursday to protest “right across from Tea Party rally.” It should be an interesting, if not occasionally wonky, show-down.

“Obama passed 25 separate tax cuts,” Sheryl Stein, founding member of “The Other 95%” said in a statement announcing the group’s plans, “including $300 billion in middle class tax cuts — one of the largest in history – as part of the stimulus package. Unlike President Bush’s 2001 tax cuts, which went to the wealthiest 2.2%, President Obama’s tax cuts overwhelmingly benefit working and middle class families — in fact, 95% of all Americans.”

And there is some indication that Americans are satisfied, generally speaking, with the current trade-off between their tax burden and the benefits that government provides. “Just ahead of Tax Day, a new New York Times/CBS News poll finds that most Americans regard the income taxes that they will have to pay this year as fair, regardless of political partisanship, ideology or income level,” the Times reported.

Perhaps even more surprising, though, is that even among the 18 percent of Americans who say they support the Tea Party movement, more than half call their own income tax fair. Sentiment turns more sour, however, among the smaller group of Tea Party supporters who are active in the movement. Most of them, 55 percent, regard the income tax they have to pay as unfair. Thousands of Tea Party supporters gathered in Boston today for a rally near the original site of the Boston Tea Party.